Credit Card Payment Question

Redthistle

15 years ago

Related Stories

WORKING WITH PROS10 Questions to Ask Potential Contractors

Ensure the right fit by interviewing general contractors about topics that go beyond the basics

Full Story

MOST POPULAR10 Things to Ask Your Contractor Before You Start Your Project

Ask these questions before signing with a contractor for better communication and fewer surprises along the way

Full Story

LIFEHow to Navigate an Extended Guest Stay

Keep sharing living quarters a positive experience by pondering the answers to these questions in advance

Full Story

DECLUTTERINGClutter vs. Keepers: A Guide to New Year's Purging

Simple questions to get in touch with your clutter comfort level — and figure out what needs to go

Full Story

BATHROOM DESIGNHow to Settle on a Shower Bench

We help a Houzz user ask all the right questions for designing a stylish, practical and safe shower bench

Full Story

MOVING5 Risks in Buying a Short-Sale Home — and How to Handle Them

Don’t let the lure of a great deal blind you to the hidden costs and issues in snagging a short-sale property

Full Story

TRAVEL BY DESIGN10 Ideas for Packable Decor From Your Travels

It's fun to decorate with finds from a trip — but not so fun to lug them home. These ideas are affordable and easy on the suitcase

Full Story

HOME TECH7 Ways to Charge Up and Connect After Disaster

Products and tips for communicating and keeping essential items running till the power's back on

Full Story

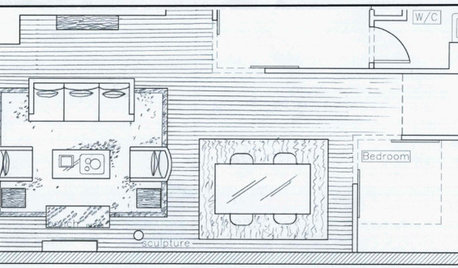

DECORATING GUIDES9 Planning Musts Before You Start a Makeover

Don’t buy even a single chair without measuring and mapping, and you’ll be sitting pretty when your new room is done

Full StoryMore Discussions

rick_mcdaniel

RedthistleOriginal Author

Related Professionals

Erie Landscape Architects & Landscape Designers · Southfield Landscape Architects & Landscape Designers · Apollo Beach Landscape Contractors · Chesapeake Ranch Estates Landscape Contractors · Hurricane Landscape Contractors · Mahwah Landscape Contractors · Middletown Landscape Contractors · Markham Landscape Contractors · New Carrollton Landscape Contractors · Crowley Landscape Contractors · Golden Valley Landscape Contractors · Spokane Window Contractors · Denver Window Contractors · Idylwood Window Contractors · Tamarac Window Contractorsrick_mcdaniel

pjtexgirl

liz_h

linda_tx8

seamommy

maden_theshade

seamommy